By Richard Fitzgerald, Founder & CEO of Augustus Media

The MENA media industry is undergoing a transformative period, driven by global trends, regional initiatives and evolving consumer behaviors. From surging media investments to the consolidation of industry giants, 2025 is shaping up to be a pivotal year. Here’s a deep dive into the top 10 predictions that will define the MENA media landscape in the coming year.

1. Media Spend Reaches Unprecedented Levels

Global media spend is forecasted to hit a record $1 trillion in 2025, with the MENA region playing a crucial role. Regional media investments are projected to reach $1.1 billion, bolstered by growth in influencer marketing, which accounts for up to 40% of marketing budgets in some cases. Initiatives like Dubai’s AED Fund and the Billion Followers Summit exemplify this momentum.

While geopolitical challenges, such as the ongoing genocide in Gaza, led to a $750 million decline in media spend in 2023, recovery is on the horizon. The Gulf remains the primary driver of spending, though optimism is building for emerging markets like Iraq and Egypt, and even hopes for eased sanctions in Syria.

Alphabet, Meta, and Amazon will dominate the $1 trillion global advertising market, accounting for 41% of total sales—over $400 billion. This concentration is driving agency consolidation in the MENA region, reshaping how advertising budgets are allocated and managed.

2. Consolidation Reshapes the Industry

Consolidation among media giants is intensifying. Google faces regional competition from Yandex, which is rapidly gaining traction in maps, search, and ad tech. Meanwhile, TikTok is outpacing Snapchat in key markets like Saudi Arabia.

Abu Dhabi’s RedBird IMI is speculated to acquire CNN globally, leveraging its existing ownership of CNN Arabic to position the UAE as an international media hub. The Omnicom-IPG merger is another game-changer, combining brands like OMD, PHD, and Hearts & Science with Magna, UM, and Initiative. This merger will redefine how media is bought, with merged brand names and inevitable redundancies expected.

3. Podcasting and Audio Platforms Flourish

Audio content continues its ascent in MENA. Platforms like Anghami are bundling services with OSN+ to rival Spotify, while Podeo, backed by $5 million in funding, is set to expand its podcast offerings.

Notable shows like Finjan—the most-watched podcast on YouTube in 2024 under Tamanya (SRMG)—demonstrate the region’s appetite for compelling audio content. The UAE is also vying to attract global creators to host their shows locally, reinforcing its position as a podcasting hub.

4. Streaming Wars Intensify with New Content Formats

The battle for streaming dominance continues, with content remaining the key differentiator. Dubai Bling Season 3 and influencer-led shows on OSN are poised to captivate audiences. Riyadh Season’s events, such as Elie Saab’s 1001 Nights, exemplify the integration of live events with digital storytelling.

DAZN is emerging as a leader in sports streaming, particularly with the FIFA Club World Cup featuring regional powerhouses like Al Ahli and Al Hilal. Meanwhile, Shahid, backed by Saudi Arabia’s PIF, is expected to solidify its dominance, while smaller players like Zee TV’s Weyyak may exit the market due to mounting pressures.

5. AI Original Content Will Develop at a Rapid Pace

ChatGPT emerged two years ago in late 2022, sparking a generative AI craze that is transforming media companies’ operations. From automated workflows to articles, videos, and images, AI companies have been raising funds, and content companies are adopting the new software at pace.

The latest from OpenAI, Sora, is set to change media once again. Will we be watching fully AI-made movies in cinemas by year-end? Very possible.

6. Corporate Tax Shifts Reshape Operations

With corporate tax rates in the UAE rising to 15%, media companies must reconsider their headquarters and operational strategies. This policy change will particularly impact global firms headquartered in tax-friendly locations like Dublin, prompting a reconfiguration of regional operations.

7. Riyadh Season Will Continue to Become a Bigger Media Event

Without an Olympics, AFCON, or World Cup, 2025 can still have its moments. Ramadan, early in the year, will see increased engagement on streaming and social media across the region.

Last year, a Riyadh Season event—almost unannounced as a media tentpole event—captured the imagination: Elie Saab’s 1001 Nights. Riyadh Season is getting bigger and better every year as a media event. Expect more, as His Excellency Turki Al-Sheikh was overheard telling creator iShowSpeed to “Do something crazy next year for Riyadh Season, bigger than Mr. Beast.”

8. Emerging Media Brands Carve Their Niche

Innovative media startups like FWD are thriving with newsletter-first and social media-centric models. However, others, such as Moniify, may struggle due to unsustainable growth strategies. Established players like Blinx will explore monetization strategies to remain competitive in a crowded landscape.

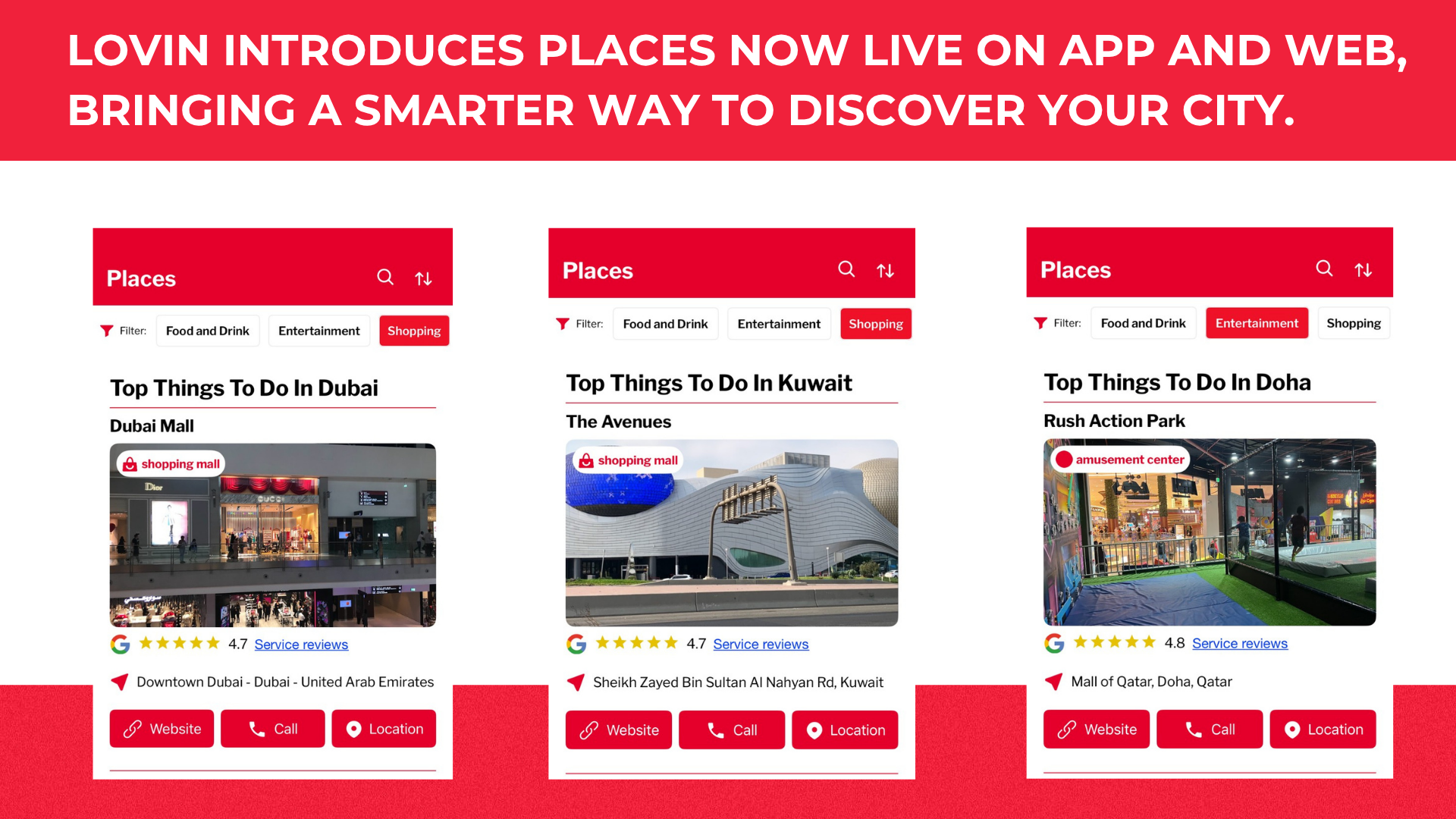

Our own Lovin’ brands are in over 20 cities, while Smashi Business and Smashi Sports continue to fill a new media gap. Blinx, at just over one year old, is garnering attention in Saudi Arabia.

9. Mergers and Acquisitions Accelerate

UAE-based media giants such as DMI and IMI are eyeing acquisitions to expand their influence. This trend reflects the growing need for scale and resource pooling in an increasingly competitive market.

SRMG, MBC, and Anghami are already on public markets. Will StarzPlay Arabia list separately? What will OSN do? It’s likely we’ll see some sort of Kipco sale for OSN. Meanwhile, Anghami OSN+ could spin out as its own listed entity.

10. Influencer Marketing Enters a New Era

As influencer marketing approaches parity with traditional media spend, expect heightened regulation and professionalization. Platforms and marketers will collaborate to tackle challenges like ROI measurement and ensuring audience authenticity.

The MENA media industry is at a crossroads, shaped by geopolitical, economic, and technological forces. From record-breaking media investments to bold acquisitions and innovative content formats, 2025 promises to be a landmark year. As the region solidifies its position on the global media stage, these predictions underscore the dynamic and fast-evolving nature of the industry.

Augustus Media

Augustus Media